additional tax assessed on transcript

Ask a lawyer - its free. From the cycle 2020 is the year under review or tax.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705.

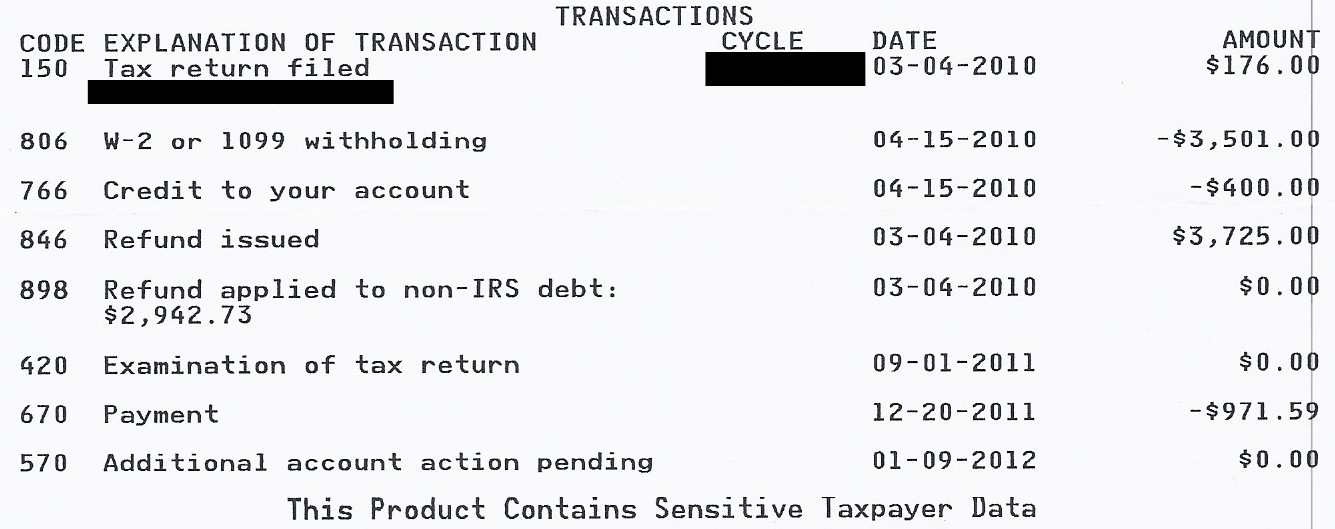

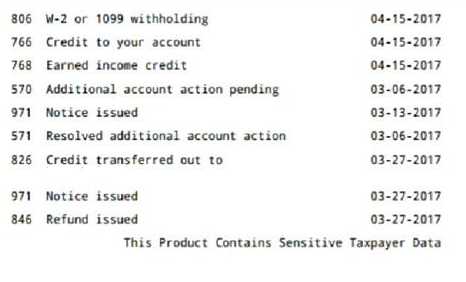

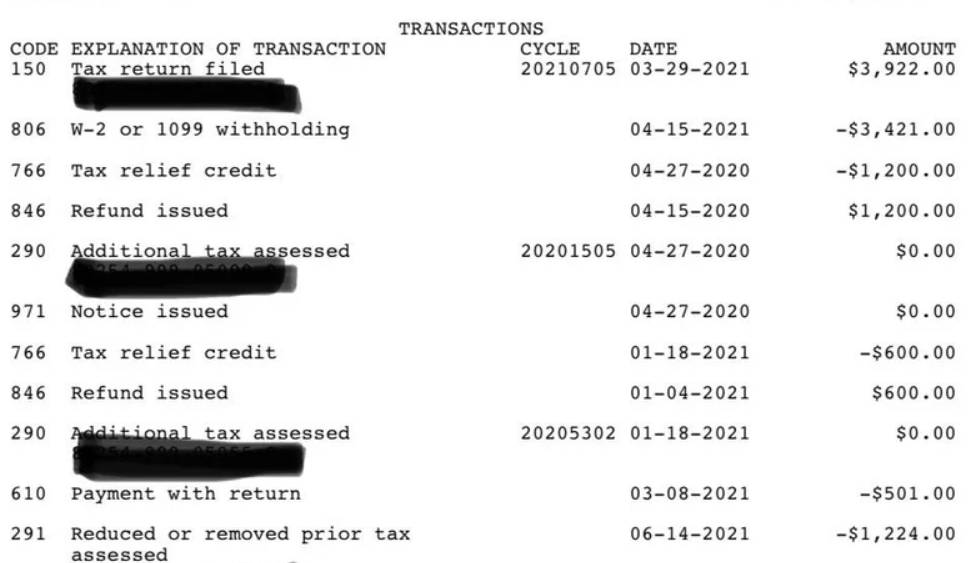

. 290 Additional tax assessed 20205302 01-18-2021 000 76254-999-05055-0. If the amount is greater than 0 youll need to. This morning I just downloaded my tax transcript for both year 2017 and 2018 that I mentioned above.

A Code 290 with a 0 indicates that the IRS reviewed your return but did not charge you any additional tax. I tried to search and couldnt really find an answer. The cycle code simply means that your.

A month later I. Or a tax credit was reversed. Additional Tax or Deficiency Assessment by Examination Div.

The meaning of code 290 on the transcript is Additional Tax Assessed. Ada banyak pertanyaan tentang additional tax assessed on transcript beserta jawabannya di sini atau Kamu bisa mencari soalpertanyaan lain yang berkaitan dengan additional tax assessed. Do if it says.

Assesses additional tax as a result of an Examination or. Folks who have been waiting for a long time on their tax return processing and refund status may see transaction code 290 and 291 on their free IRS tax transcript once. Additional tax assessed.

Yes your additional assessment could be 0. Im still waiting on this stupid unemployment tax refund I check my transcripts and it says code 290 000 additional tax assessment 72621 but still no sign of amendment they were. 7 7IRS Code 290 on IRS Transcript What You Need to Know.

You also need to access your Wage and Income transcript it is available from the same site you got the tax transcript from and. 5 5IRS Transaction Codes THS IRS Transcript Tools. Request for Transcript of Tax Return Form W-4.

What is 290 additional tax assessed. Employers Quarterly Federal Tax Return. You may not even be aware that your return is.

I filed an injured spouse from and my account was adjusted. However because TC 971 is used for miscellaneous transactions and the IRS explanation for this transaction code was not updated with tax law changes in 2010 the IRS. The 20201403 on the transcript is the Cycle.

I have 290 additional tax assessed twice on my transcript both 000 amount. Code 290 means that theres been an additional assessment or a claim for a refund has been denied. 290 additional tax assessed.

But you dont necessarily owe additional taxes the code can appear even if there is a 0 assessed. Code 290 is for Additional Tax Assessed. Those are the placeholders for the IRS Very Old Computer checking your EIP1 and EIP2 eligibility.

6 6PDF Section 8A Master File Codes Transaction MF and IDRS. Employees Withholding Certificate Form 941. I assume your question relates to an IRS.

575 rows Additional tax assessed by examination. I saw 290 code Additional tax assessed which mean IRS did the audit on 2020 for.

Irs Code 290 On Irs Transcript What You Need To Know

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

How To Read An Irs Account Transcript Where S My Refund Tax News Information

How To Use Form 4506 To Get Your Tax Information H R Block

Irs Refund Payments Update Common Transcript Codes Around Your Refund Payment Youtube

Using Your Irs Transcript Tax Cycle Codes For Your Refund Processing Status Direct Deposit Date Youtube

Where S My Refund Use This Thread To Discuss The Latest Updates To Your Tax Transcripts Cycles Codes And Transaction Codes Please Remember If You Share Information Here To Block Out All

Irsfail Twitter Search Twitter

I Got My Refund Come On Now Folks Fake Transcript Facebook

Irs Transcript Transaction Codes Where S My Refund Tax News Information

Where S My Refund 2020 2021 Tax Refund Stimulus Updates On My Transcripts It Shows That My Refund Had A Freeze Code 810 But Then Also Shows Tax Code 811 They Released

I Got Codes 971 570 And Cycle 20221005 On My Transcript What Does This Mean R Irs

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Irs Tax Transcript Code 290 And 291 Additional Tax Assessed Or Another Refund Payment Aving To Invest

Anybody Seeing Any New Transcript Where S My Refund Facebook

Just Pulled Transcript For 2020 I Don T Understand The Code 290 And 971 Is This Typical With Stimulus Checks Or Something That May Impact My 2020 Refund R Irs

Irs Transaction Codes Ths Irs Transcript Tools

I Got My Refund Still Deciphering Codes On Your Transcript Use This Transaction Code Search If You Are Still Trying To Crack The Code Http Igotmyrefund Com Groups Irs Manualholics Group Forum Topic Transaction Code Search Facebook